Collectible Coins in 2024

A Journey Through Time: The Rich History of Collectible Coins

I’m about to take you back in time, to the very inception of what we now know as coin collecting. Coin collecting is no modern-day fancy; it’s an ancient hobby that has been practiced for thousands of years. In fact, historians suggest that as soon as coins were minted, there were collectors. Back then, kings and noblemen began the trend, coveting coins not just for their monetary value but for their artistry and connection to power.

The fervor for collecting took a different shape during the Renaissance, branded as the ‘Hobby of Kings,’ with European monarchs and the elite gathering ancient coins as symbols of wealth and wisdom. It was during this period that coin collecting evolved from mere acquisition to a more scholarly pursuit. Collectors sought to preserve history through these coins, delving into their stories, their origins, and their significance across different cultures.

Fast forward to the 19th century, as the middle class emerged, coin collecting underwent a democratization. No longer the exclusive pastime of aristocracy, it became accessible to anyone with an interest in history and numismatics—the study of currency. Philanthropists and historians alike saw value in these small metallic pieces, sparking widespread interest and starting the journey towards modern numismatics.

This isn’t just about the wealthy and the academics, though. Historical events such as the California Gold Rush and the discovery of large coin caches have continually reshaped the landscape of coin collecting, making it an exciting and evolving field. Each epoch added a layer to the narrative of coin collecting, enriching the hobby with diverse perspectives and expanding its community.

Now that you’ve stepped through the rich history of collectible coins, you’re ready to understand the nuts and bolts of coin grading – a crucial element in the world of numismatics. Coming up next, we’ll explore what goes into the rating of coins, and why it’s such a pivotal aspect of coin collecting.

Decoding the Digits: An Overview to Coin Ratings

In the world of collectible coins, a small difference in quality can significantly impact a coin’s value. That’s where coin ratings come into play, providing a standardized measure of a coin’s condition. The highest grade given to a coin is ‘ms70‘, a coveted identifier that signifies perfection to collectors.

Coin grading systems evolved as a means to create universal standards in the coin-collecting community. The ms70 rating, falling under the umbrella of what’s known as the Sheldon Scale, indicates a coin that’s in pristine condition, with no post-production imperfections visible under 5x magnification.

Besides the ms70 rating, there are several other grades a coin can receive. These range from cull, or coins that are worn or damaged, to grades in the 60s which reflect coins just below perfect condition. Other well-known grading scales include the European grading system and the ANA (American Numismatic Association) standards.

So why is this grading so crucial? A coin’s grade can dictate its market value, its rarity, and ultimately, its desirability to collectors. Establishing the grade of a coin typically involves professional coin grading services that utilize the expertise of numismatic experts and specialized equipment to provide an unbiased assessment.

As we transition to considering the timing for buying collectible coins, understanding the grading scale is fundamental. Knowing the potential value of a coin in its rated condition is essential for making an informed investment. This factors significantly into the debate on whether it’s a good time to purchase these pieces of history.

Is Now the Golden Opportunity to Acquire Collectible Coins?

I’m about to tackle a pretty timely question: Is now the right moment to buy collectible coins? It’s a common topic of conversation among precious metal investors, and the consensus seems to point towards the affirmative.

Consider the traditional appeal of precious metals. Gold, silver, platinum, and palladium have always been highly sought after. Their intrinsic value is not just about beauty, but also about functionality in various industries. Moreover, when the economy shows signs of inflation or potential downturns, these metals historically become even more desirable.

I’m saying, if you’ve ever been curious about collecting coins, the ‘seize-the-day’ adage fits perfectly in the current scenario. Let’s look at it this way: outside the realms of coin collecting, people are increasingly wary of markets that seem more like roller coasters. They want something solid, something that has proven to withstand the whims of economic change.

Collectible coins offer this sense of security. However, it’s crucial to recognize their dual nature. They are commodities, bound by the swings of the metals market, but also unique collectibles with aesthetic and historical value that often transcend pure metal content.

The bottom line? If your interest in collectible coins is piqued, now is a strategic time to consider making a move. You’re not just buying metal; you’re acquiring pieces of history that have a habit of retaining value, often outpacing inflation. That said, don’t leap without looking. The next section will guide you through navigating these enticing waters with the insight of an investor.

Beyond the Collector’s Display: The Investment Merits of Collectible Coins

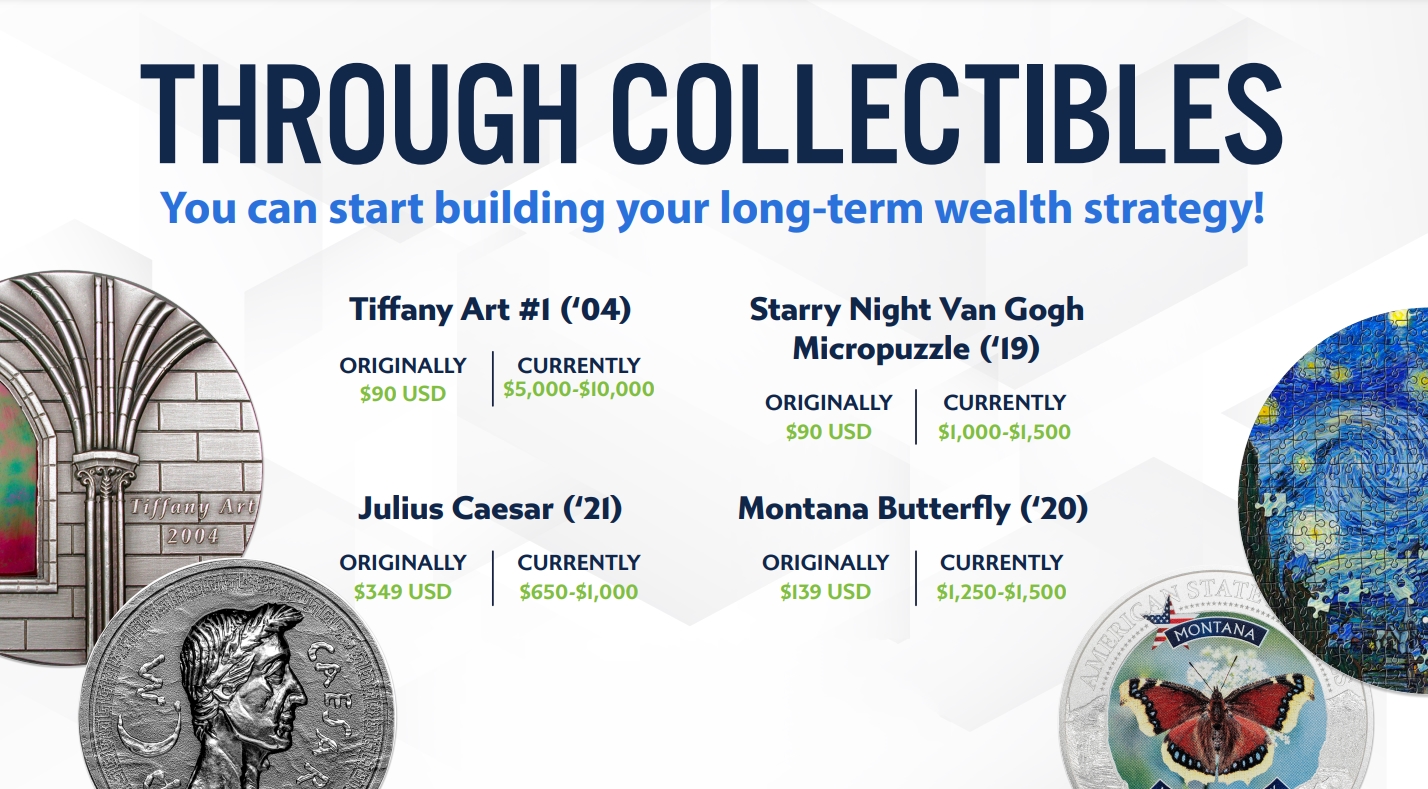

If you’re considering diving into the world of collectibles, coins offer a unique blend of history, art, and investment opportunities. You might start simply fascinated by the designs or the stories behind each piece. But what you’ll quickly realize is that collectible coins serve a dual purpose: they’re not only a joy to collect but can also bolster your financial strategy.

Now, I’m not saying that every coin out there is going to yield a profit. Like any investment, there’s an element of risk and reward. However, for those who’ve done their homework, collectible coins have shown remarkable resilience, often appreciating over time. The key is to choose something that resonates with you and aligns with your investment goals.

It’s crucial to understand the specifics of what you’re investing in. If you’re all about the weight of the metal, collectible coins with a high premium for their numismatic value might not be for you. Think strategy. Are you hedging against inflation? Seeking portfolio diversity? Or perhaps you’re aiming to own a piece of history? Your objectives will guide your choices.

Ultimately, collecting coins is a rewarding venture for the right person. It combines the tangible satisfaction of holding a piece of crafted metal with the potential for financial return. It’s no wonder coin collecting has stood the test of time. Whether you’re a seasoned numismatist or a budding enthusiast, the market for collectible coins is ripe with opportunity.

As always, before you leap, look. Research your options, talk to experts, and attend coin shows or auctions to get a feel for what’s out there. The more you know, the better prepared you’ll be to make wise decisions. And remember, an investment in collectible coins isn’t just a financial choice—it’s a personal journey into a world rich with history and beauty.

7K Metals: A Great Starting Point

7K Metals is an intriguing option for those interested in starting or expanding their coin collection. This company offers a unique model that blends the worlds of numismatics and network marketing, providing both an opportunity to collect valuable coins and a potential income stream through its membership structure.

Firstly, 7K Metals emphasizes the value of collecting precious metal coins as a form of tangible wealth. Coins made of gold, silver, and other precious metals have inherent value that can act as a hedge against inflation and economic downturns. Unlike paper currency or digital assets, precious metal coins maintain intrinsic value due to their material content.

Secondly, the company offers a curated selection of coins, which can be especially appealing to new collectors who might feel overwhelmed by the vast options available in the numismatic market. 7K Metals provides access to exclusive and limited edition coins, which can be particularly attractive for collectors looking to acquire items with potential to increase in value over time.

Moreover, 7K Metals educates its members about numismatics and precious metals investment, offering resources and information to help collectors make informed decisions. This educational aspect can be invaluable for both novice and experienced collectors, as it enhances their ability to select coins that align with their collecting goals and investment strategies.

Another significant advantage is the company’s network marketing structure, which allows members to earn commissions and bonuses by referring new members. This can provide a financial incentive to engage with the coin collecting community and share one’s passion for numismatics with others. While this aspect might not appeal to every collector, it offers a unique approach to integrating the hobby of coin collecting with an opportunity for entrepreneurial endeavor.

Additionally, 7K Metals promotes a sense of community among its members, providing a platform for collectors to connect, share their experiences, and learn from one another. This community aspect can enhance the collecting experience, offering support and camaraderie that can be especially beneficial for those new to the hobby.