Is Buying Gold A Good Investment?

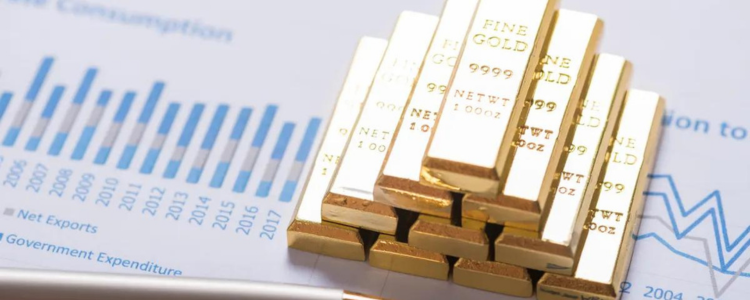

Good question? I start by considering gold’s enduring value. For millennia, gold has been a symbol of wealth and a medium of exchange. Its appeal spans cultures and time, solidifying its position as a cornerstone of financial systems. Even today, it commands a significant role in the portfolios of individual investors and national reserves.

I reflect on the relentless allure of gold. Despite the advent of sophisticated financial instruments and digital assets, gold’s sheen remains undiminished. Its worth isn’t merely measured in currency, but in its historical heritage as well. Owning gold is a time-honored tradition, and it carries a sense of permanence and stability that few other assets can claim.

I transition carefully into its contemporary application. In our current economy, gold isn’t just about legacy; it’s a strategic asset that offers a unique set of financial benefits. It’s versatile — suitable for both seasoned investors and those new to the market. As I shift to the next section, I will paint a clearer picture of these financial benefits and why gold could be a valuable addition to your investment strategy.

The Gleaming Advantages of Adding Gold to Your Portfolio

Gold has long captivated investors with its reputation for stability during tumultuous times. The metal’s intrinsic value is not pegged to a government or financial entity, which lends it a unique degree of independence from geopolitical and macroeconomic issues. This characteristic works in favor of investors seeking a haven that has historically held its ground.

In your efforts to sculpt a resilient investment portfolio, diversification stands paramount. Gold’s low correlation with other financial assets like equities and bonds means that when they dip, gold does not necessarily follow suit. It can be the counterbalance on your fiscal seesaw.

Another compelling reason to consider gold is its established role as a hedge against inflation. As living costs rise and the purchasing power of currency weakens, gold often maintains or increases its value. Think of it as a financial anchor, helping to keep your wealth from being eroded by inflation’s relentless tide.

Furthermore, the metal’s safe-haven status has been confirmed through its performance during periods of financial uncertainty. When the dark clouds of economic crises loom, investors often flock to gold, driving up its price. This can protect, and sometimes enhance your investment at times when it’s needed most.

Consider including gold in your portfolio as a strategic move – it’s not just about owning a shiny metal but embracing a powerful tool that can safeguard your assets and provide peace of mind.

Navigating the Pitfalls of Precious Metals

Despite its reputation, gold isn’t perfect. Like any investment, it comes with its share of downsides.

First, it’s crucial to address gold’s price volatility. Though less erratic than some assets, gold prices can swing based on global economic conditions, currency fluctuations, and investor behavior. These changes can affect the value of your investment unexpectedly.

Then there’s the issue of storage. If you opt for physical gold, whether it’s bullion or coins, you must consider safe and secure storage. This often means paying for a safety deposit box or a home safe, which adds to the cost of your investment.

Finally, gold differs from interest-bearing assets like bonds or dividend-yielding stocks. It doesn’t generate income or dividends while you hold it. Instead, the return on gold investment relies solely on price appreciation, which isn’t guaranteed.

As you weigh these challenges, consider how gold compares to other investment options. Is it still a viable choice for your portfolio?

Gold versus The Investment Galaxy

Comparing gold to other investment options is essential to understanding its role within a broader financial context. It is a unique asset that behaves differently than stocks, bonds, and real estate, each of which carries its own set of characteristics and risks.

When you measure gold against stocks, consider the equity market’s potential for high returns. Stocks, representing shares of a company’s profits and growth, can offer dividends and capital gains. However, they can also be highly volatile and are affected by corporate performance, economic conditions, and market sentiment.

Bonds are generally considered safer than stocks, offering a fixed income over time. The stability and predictable returns of bonds contrast with gold’s lack of yield, but low interest rates can make gold more attractive by comparison as it is often sought after as a store of wealth when yields on bonds are not compelling.

Real estate investment involves tangible property and can provide rental income, capital appreciation, and tax benefits. Yet, it requires substantial capital, is not as liquid as gold, and involves additional costs, such as maintenance and property taxes.

Each asset class has a unique risk-reward profile and liquidity level. Stocks and real estate have the potential for substantial growth but come with greater market risks and require more management. Bonds offer fixed returns but might not keep pace with inflation. Gold, meanwhile, provides liquidity and a potential hedge against inflation and economic uncertainty but does not generate income in the same way these investments can.

Your investment choice should be influenced by your financial goals, time horizon, and risk tolerance. By considering all these factors, you can determine where gold fits within the spectrum of your investment portfolio and how it can complement other assets.

Deciphering if Gold Glitters for Your Portfolio

So, you’ve sought answers on whether gold can reinforce your investment fortress. The journey through the merits and complexities of gold has brought us here: evaluating its rightful place within your portfolio.

Harvesting benefits from gold doesn’t come from mere possession; it stems from strategic integration considering your personal financial plans and risk propensity. If security in tumultuous times is what you value, gold may resonate with your investment philosophy.

However, if your approach thrives on growth and passive income, you’ll need to balance gold’s non-yielding shimmers with yield-bearing assets. Remember, an ideal portfolio varies for each investor—it’s not one-size-fits-all.

Before taking the golden leap, scrutinize your goals, consult with financial experts, and educate yourself continuously. Investment, much like alchemy, is an art, turning informed decisions into potential prosperity.

So, is gold a good investment? It can be a strategic asset that adds a resilient layer to your investment portfolio, provided it aligns with your goals. Reflect deeply, choose wisely, and you may find that gold indeed holds the Midas touch for you.

Gold Investment Pros

Gold Investment Cons

7K Metals

7K Metals is a company that operates within the network marketing industry, offering a unique proposition for those interested in investing in precious metals. The company aims to provide its members with the opportunity to purchase gold and silver at what they claim to be wholesale prices, which can be an attractive offer for those looking to diversify their investment portfolios with these assets.

One of the key aspects of 7K Metals is its emphasis on creating a community of investors who are passionate about precious metals. The company provides educational resources to help members understand the market and the value of their investments. This focus on education is designed to empower individuals to make informed decisions about their investments in gold and silver.

7K Metals also offers a business opportunity for members who are interested in promoting the company’s products. By referring new members, individuals can potentially earn commissions and bonuses, adding an additional layer to the investment experience. This aspect of 7K Metals appeals to those who are not only interested in investing in precious metals but also in building a business within the industry.

For those new to precious metal investments, 7K Metals could serve as a starting point to learn more about the market, gain access to precious metals, and even explore an entrepreneurial angle. However, as with any investment or business opportunity, it’s crucial to conduct thorough research and consider all aspects of the company before getting involved. Understanding the market, the business model, and the potential risks and rewards can help ensure that your investment journey is informed and aligned with your financial goals.

If 7K Metals piques your interest and you’re considering it as a gateway to precious metal investments, it’s recommended to delve deeper into the company’s offerings, reviews, and the experiences of existing members. This way, you can make a well-informed decision on whether it aligns with your investment objectives and if it’s the right platform to start your journey in the world of precious metals.

Final Thoughts

As we’ve traversed the golden path of investment wisdom together, we’ve uncovered the shimmering potential and the subtle challenges that gold presents as an asset. Whether you’re captivated by its historical allure or drawn to its stability amidst economic whirlwinds, gold holds a unique place in the tapestry of investment options.

Now, as you stand at the crossroads of decision-making, armed with insights and reflections on gold’s role in diversification, hedging against inflation, and providing a safe haven during tumultuous times, the question remains: Is gold the right glint in your investment portfolio?

If your curiosity is piqued and you’re eager to explore how this timeless asset can be woven into your financial strategy, we invite you to take the next step on your investment journey. Whether you’re a seasoned investor looking to diversify your portfolio or a newcomer seeking a solid foundation in uncertain times, understanding gold’s place in your investment mix is pivotal.

Don’t let your quest for financial wisdom end here. If you’re keen to delve deeper into the world of gold investment and discover how it can fortify your financial future, we’re here to guide you. Submit the form below to unlock a trove of further information, tailored insights, and expert guidance. Embrace the opportunity to transform knowledge into action and pave your path to investment success.

Your financial odyssey is uniquely yours, and in the realm of investment, knowledge is as precious as gold itself. By seeking more information, you’re not just making an inquiry—you’re taking a decisive step towards mastering the art of investment. Remember, in the world of finance, as in alchemy, the most informed decisions lead to the most rewarding outcomes. Take the leap, fill out the form, and discover if gold indeed has the Midas touch for your portfolio.