Is Gold and Silver a Good Investment?

Today, I’m going to be talking about gold and silver, and you’re going to find out about their unique role in the world of investments. These precious metals are more than just the stuff of pirate legends and ancient currency; they’re a cornerstone in the portfolios of savvy investors who understand their value beyond the glint.

These two metals have woven themselves into the fabric of financial stability with their appeal as traditional investment vehicles. Why? Well, they’re perceived as a safe haven during economic uncertainty, and they tend to hold their value over time. This isn’t just about their beauty; it’s also about their timeless allure in the face of inflating currencies and volatile stock markets.

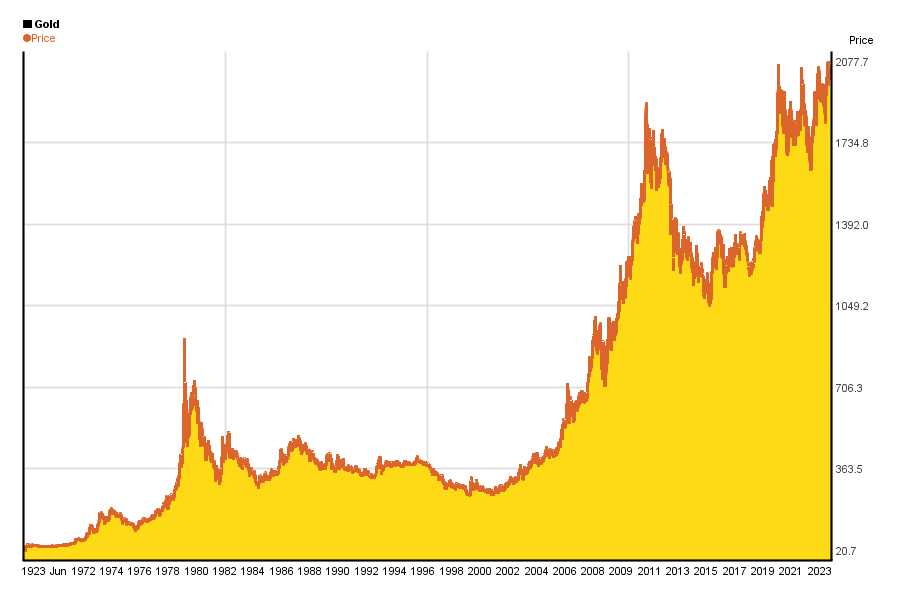

In terms of performance, if you’re picturing a steady yet impenetrable fortress of value, you’re on the right track. Gold and silver have a track record of performing differently from stocks and bonds, often zigging when others zag. That is what makes them particularly appealing for investors looking for assets that can offer a buffer against market downturns.

When you think about gold and silver in your investment strategy, don’t worry too much about the daily fluctuations. These metals are about the long game. And as we move into the next section, you’ll see just how the test of time has shaped the way we view these shimmering assets.

Time-Tested Treasures: The Historical Journey of Gold and Silver

Gold and silver aren’t just fancy trinkets; they’ve carried immense importance across numerous civilizations. Delving into their historical significance, it’s clear these metals were more than just currency; they represented power, beauty, and a stable measure of wealth. I’m going to explore their storied past and how that’s cemented their status as premier investment choices.

Looking at the timeline, the value trends of these metals have seen some fascinating changes. There’ve been times when silver was nearly as prized as gold, and others when gold clearly dominated. Historically, these fluctuations were deeply entwined with discoveries of new mines and shifts in public perception, among other factors. Your investment radar should pick up on how this shapes their present-day allure.

The key historical moments for gold and silver are often linked with significant global events. The Spanish conquest of the New World led to a flood of silver, altering its value. Gold rushes of the 19th century expanded economies at an explosive rate. These metals have seen empires rise and fall — and that’s a big part of what draws investors to them today, the sense of holding a piece of history in their hands.

Transitioning from their historical context to comparing gold and silver investments is pivotal. They share a rich past, but in the investment world, they behave quite differently. We’re going to dissect these differences in greater detail next, looking at market dynamics, investment characteristics, and how they handle economic ups and downs.

A Tale of Two Metals: Gold versus Silver in the Investment Arena

Gold and silver, while often mentioned in the same breath, dance to different tunes in the investment world. In this comparative look at the two, you’re going to find out about their market dynamics and investment characteristics. I’m going to break down how gold often plays the role of a steady, cautious dancer, while silver can be more like a spirited, unpredictable performer.

One key difference lies in their market size. Gold has a much larger market capitalization, which typically translates to greater liquidity and a denser concentration of investors. Silver, although smaller in comparison, may impress with its capacity to experience sharp price movements, offering potential for significant gains (or losses).

Inflation is often touted as a reason to invest in gold and silver. When inflation rates soar, currencies can lose purchasing power, driving investors to precious metals. Historically, gold has been the preferred safe haven because of its widespread acceptance and intrinsic value. Silver, though, also benefits during such times, albeit with more volatility.

If you’re curious about how these metals behave during economic downtimes, consider this: Gold has a reputation for being a recession-proof investment, often increasing in value when markets decline. Silver, on the other hand, has more industrial uses, which means its price can be more closely tied to the health of the global economy.

And what about during periods of economic strength? Well, that’s when silver might outshine gold. Being an industrial metal, it benefits from an uptick in manufacturing demand, which can lead to price increases. Though, remember, gold still maintains its stature during good times, bolstered by its role in jewelry and ongoing investment demand.

As we transition to understanding the economic indicators that impact these precious metals’ prices, remember that gold and silver are not just static investments. Their value hinges on a shifting landscape of economic strength, currency values, and investor sentiment. These dynamics play a monumental role in shaping the investment case for each metal. Let’s delve into those economic factors next, and I’ll show you how they can create waves in the markets for gold and silver.

Economic Tides Shaping Precious Metals Value

I’m going to let you in on a critical aspect of investing in gold and silver: understanding the economic indicators and global events that can dramatically impact their prices. There’s no crystal ball here, but knowing what factors to watch can give you a leg up in the investment game.

First up, inflation rates. These are pivotal in the world of precious metals. That’s because gold and silver often act as hedges against inflation. When fiat currency loses value, these metals typically don’t follow suit. They’ve got a history as a store of value, which is quite appealing when purchasing power starts to wobble.

Then, there’s currency value. A fluctuating dollar can mean a shifting landscape for gold and silver prices. It’s a bit of a seesaw effect: typically, when the dollar declines, gold and silver prices go up, and vice versa. This makes the metals appealing for those looking to offset currency risk.

We’ve also got geopolitical tensions to consider. Stability is the best friend of the typical stock market investor, but for those who’ve bet on gold and silver, a bit of geopolitical drama can lead to increased prices. It’s about uncertainty – and precious metals shine in times of doubt.

Now, let’s not forget about supply and demand. It’s the bread and butter of any commodity’s pricing. Disruptions in mining, changes in regulations, or new technological uses for these metals can swing the needle in either direction.

Heading into our next section, we’ll talk about how all these factors converge into the practical implementation of gold and silver in your investment portfolio. You’re going to find out how to leverage their unique characteristics for diversification, all while navigating the inherent risks they carry. This isn’t just about adding a shiny asset to your portfolio; it’s also about crafting a financial bulwark that can weather the market’s storms.

Navigating the Future: Planning with Precious Metals

So, what does the road ahead look like for gold and silver investors? We’re looking at an ever-changing landscape, and no one has a crystal ball. However, there’s a consensus among experts that gold and silver hold an intrinsic value that is likely to endure over time.

These precious metals have seen civilizations rise and fall, and yet they continue to be sought after. In my opinion, part of this endurance comes from their versatility and tangible value. Gold and silver can be both investments and industrial commodities, which provides a unique position in the market.

Investors who are considering gold and silver should pay close attention to the market indicators discussed earlier. They should also remain aware of technological advancements and trends in consumer behavior. For instance, silver’s role in green technologies and electronics screams potential.

I’d suggest that if you want to add gold or silver to your portfolio, choose a level of investment that resonates with you and aligns with your risk tolerance. Remember, diversification is key, and these metals could be one part of a broader investment strategy. You can always adjust your approach down the road.

To sum it up, gold and silver remain fascinating options for investors keen on adding a timeless quality to their portfolios. They aren’t without their risks, of course, but with the right balance and ongoing education, they offer a path that’s rich with history and potential. Before you make any decisions, make sure to consult with a financial advisor to ensure it’s the right move for you.

7K Metals – A Key Player in the Gold and Silver Industry

As a member of 7K Metals, I’ve come to recognize the significant and positive impact our company has on the gold and silver industry. Our unique approach, centered around a membership system, enables individuals like me to access gold and silver at prices that are closer to wholesale, making these precious investments more attainable for a wider audience.

One aspect of 7K Metals that I particularly value is our commitment to education. The company offers an abundance of resources and training, which has been instrumental in deepening my understanding of the value of investing in gold and silver. This education covers the historical significance of these metals, the economic factors influencing their prices, and the strategic role they can play in a diversified investment portfolio. This knowledge empowers us, the members, to make well-informed decisions regarding our investments.

Moreover, 7K Metals champions the concept of financial security and independence through the accumulation of tangible assets. In today’s fluctuating economic environment, the company’s advocacy for physical gold and silver as a hedge against inflation and a method for wealth preservation resonates deeply with me. It offers a compelling alternative to the traditional financial avenues, which often seem riddled with uncertainties.

The sense of community within 7K Metals is another facet that I find incredibly valuable. The company has fostered a network where individuals sharing an interest in precious metals and financial freedom can connect. This community offers a platform for exchanging ideas, sharing experiences, and supporting one another, which I find immensely beneficial, especially for those of us who are relatively new to precious metals investing.

Finally, I am proud of 7K Metals’ commitment to ethical sourcing and responsible practices in the gold and silver industry. Our company prioritizes sourcing from reputable suppliers, ensuring that the metals we invest in are not only of high quality but also ethically obtained. This dedication not only benefits us as members but also aligns with broader initiatives to ensure sustainability and ethical responsibility within the industry.

In essence, my experience with 7K Metals has shown me firsthand how the company positively influences the gold and silver industry. Through education, promoting financial independence, fostering a supportive community, and emphasizing ethical practices, 7K Metals plays a crucial role in enhancing the appreciation and understanding of gold and silver as vital components of financial security.

Concluding Thoughts

In this article, we looked at the value of investing in gold and silver, emphasizing their historical significance, market dynamics, and role in diversification and risk management. It explores their performance compared to other investments, their behavior in different economic conditions, and factors influencing their prices. The piece also delves into the benefits of 7K Metals, a company offering educational resources and a community for investors in precious metals

five videos are waiting for you on the next page